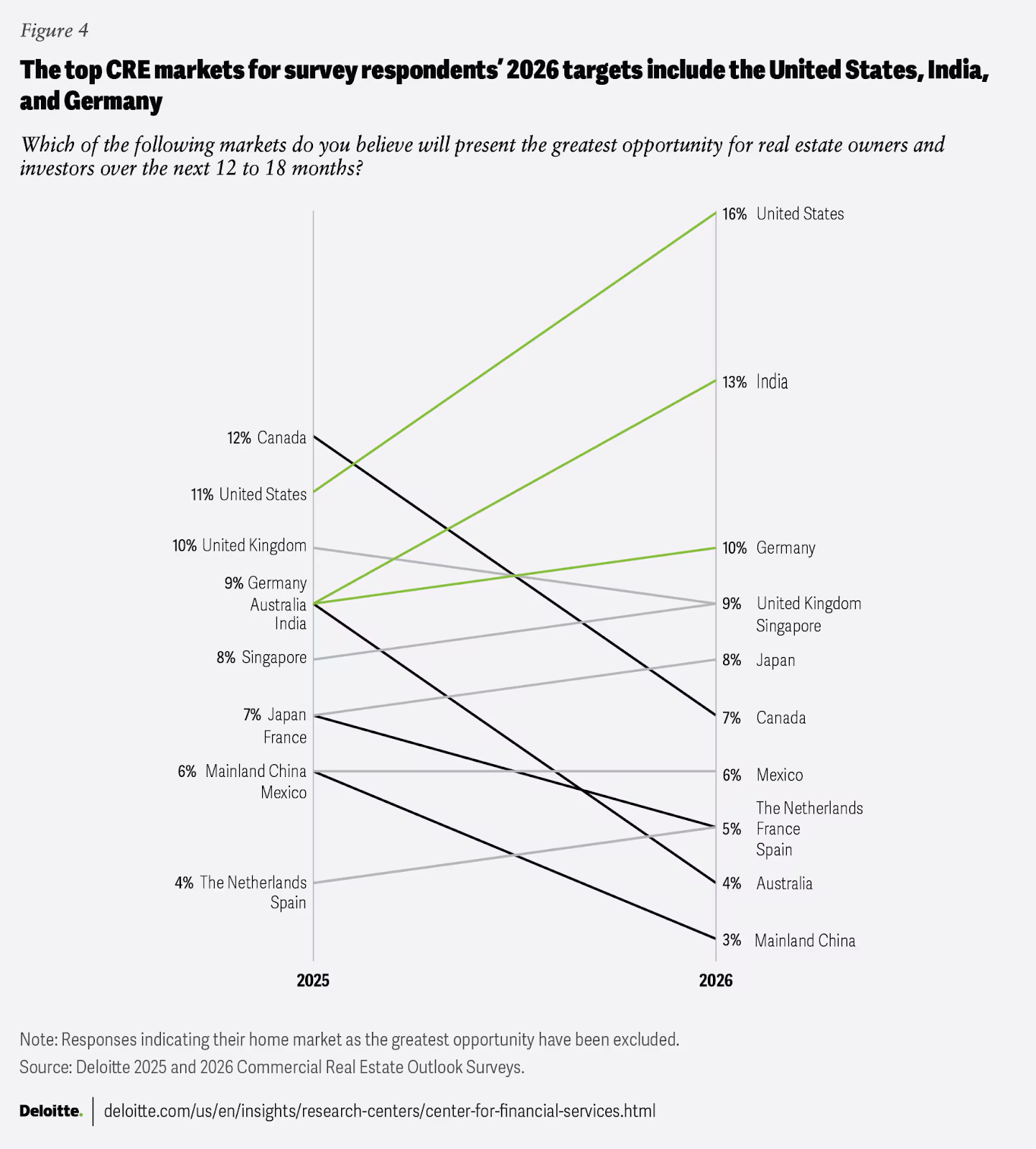

According to Deloitte, commercial property sales activity in the Americas rose 12% year over year through June 2025, continuing the positive market dynamics that began late last year. Their survey also shows that the United States remains a preferred investment market for 16% of global respondents.

Source: Deloitte

At the same time, renewed demand doesn’t guarantee a quick sale. In fact, with more transactions coming to the commercial real estate market, buyers gravitate toward the most organized and responsive sellers. This is why preparedness and speed matter.

Selling commercial real estate (CRE) is a documentation-heavy process, and a typical sale takes months as buyers verify financials, inspect the property, and review due diligence materials. When information is incomplete or hard to access, deals stall, retrades increase, and closings get pushed back.

If you’re looking for how to sell commercial real estate successfully, the formula is simple — combine fundamental real estate sales techniques with dedicated real estate data rooms. The solution centralizes documents, controls buyer access, and streamlines the review process. The result is more qualified buyers, fewer repetitive questions, and a shorter path to closing.

Our guide walks you through the core steps of selling commercial property, highlights practical real estate tips for sellers, and shows where a data room makes the biggest impact on speed and buyer confidence.

The core steps in selling commercial real estate property

The core stages a seller should follow to maximize speed, minimize friction, and attract prospective buyers include the following:

Step 1: Understand your property and the market

Evaluate the property type, location, net operating income (NOI), and tenant mix to identify the value proposition.

✔️Property type – shapes the pool of potential buyers and determines which property’s valuation metrics and leasing dynamics matter.

✔️Location – affects market demand, potential rental income, and long-term growth potential, influencing buyer interest and pricing strategy.

✔️NOI – quantifies the property’s current profitability and is a key benchmark for investors.

✔️Tenant mix – reflects income stability and risk diversification, showing buyers how resilient and attractive the commercial real estate property is over time.

Seek out comparable properties. When you know where your business property fits, you can set competitive pricing, anticipate buyer questions, and implement effective marketing.

Taking the time to analyze the market upfront is one of the most important real estate sales tips for sellers seeking faster closings.

Step 2: Prepare the property and the numbers

Physical condition and financial clarity are critical. So, address repairs, enhance curb appeal, and ensure the property presents well for inspections and tours.

Equally important is preparing clean financial documentation, including the rent roll, trailing twelve months (T-12) statement, lease agreements, and operating expenses (OPEX).

Early organization of these documents not only allows buyers to review efficiently but also builds confidence and supports faster commercial real estate sales.

👁️🗨️Note: The T-12 statement is more relevant for multifamily properties, where leases typically run 12 months. By comparison, office buildings, retail, and industrial leases often span from 5 to 25+ years.

Step 3: Decide whether to use a commercial real estate broker or sell without a realtor

Choosing the right approach depends on your experience, network, and the size of the transaction. A commercial real estate broker can provide expertise, access to buyers, and negotiation support. At the same time, some sellers may prefer to handle the commercial property sale themselves, especially for smaller or owner-managed properties.

| Pros of using a CRE broker | Cons of using a CRE broker |

|---|---|

| Access to a broad network of qualified buyers | Commission fees |

| Professional marketing, including listings and off-market outreach | Less control over marketing and communications |

| Guidance on pricing, negotiations, and closing procedures | Possible longer timelines if the broker’s schedule or strategy doesn’t align with the seller’s |

| Due diligence and buyer communications support |

Experienced property owners may know how to sell commercial real estate without a realtor, especially when they have direct buyer relationships or manage smaller deals. In either scenario, a dedicated data room can elevate professionalism, centralize documentation, and help an owner-led process appear as polished as a broker-led sale.

Step 4: Market the property and qualify buyers

Effective marketing combines visibility with selectivity. List your commercial property on online marketplaces, leverage broker networks, and pursue off-market opportunities to reach potential buyers. At the same time, it’s essential to screen leads carefully. Verify proof of funds, review track records, and assess buyer seriousness.

Video resources: Selling Commercial Real Estate is a Game. Here’s How to Win. Check out this video with Justin Ryder, Commercial Real Estate Advisor at SVN Stone Commercial, Lexington, KY. He explains how to ask the right questions to guide buyers’ decisions without pressure.

After listing and screening, focus on presenting the property professionally, targeting the right buyers, qualifying prospects early, and using structured processes to keep the transaction moving smoothly.

🔜 Later in this guide, we share additional real estate selling tips and techniques to help you optimize your marketing and negotiation strategy.

Step 5: Manage due diligence and negotiations

Due diligence is often where deals stall. Specifically, disorganized or incomplete information sellers may provide creates friction and frustrates buyers.

To avoid errors and inefficiencies, use reliable data storage solutions like data rooms to streamline document access and collaboration. With the right platform, buyers can review materials quickly, questions are minimized, and negotiations stay on track

Step 6: Closing process

Closing real estate deals involves coordinating contracts, legal documentation, and financial transfers. Maintaining clean records and clear communication throughout the process minimizes last-minute issues. Therefore, sellers who have organized their property, financials, and buyer interactions in data rooms ahead of time experience smoother closings and fewer delays.

When your numbers, documents, and buyer process are aligned, deals move. A virtual data room is what makes that happen. Next, we explore how the solution can accelerate your sales.

How a CRE deal room helps to sell commercial real estate fast

A commercial real estate data room is a secure online workspace that centralizes deal documents, protects sensitive information, and provides a feature-rich collaboration platform for buyers, advisors, and stakeholders. Instead of relying on scattered email threads or outdated file folders, a data room offers a structured, permission-controlled space for all parties involved.

Additional resources: Learn more about real estate data rooms, their use cases, core features, and tips for choosing the best solution.

Why data rooms are a new baseline for buyers

Institutional and experienced buyers use structured underwriting workflows. These workflows rely on quick and reliable access to relevant documents. Therefore, buyers expect sellers to provide well-organized information so their review and decision-making can proceed efficiently.

A professional data room provides version control, security, and a collaborative workspace for analysts, attorneys, and investment committees. In mid-to-large CRE deals, particularly, it signals that the seller is organized and deal-ready, making it a standard expectation rather than a nice-to-have.

Here is how the software simplifies real estate deals:

1. Organizing deal documentation upfront

A CRE deal room helps sellers streamline due diligence by organizing all critical documents before buyers access them. Structured and accurate data not only allows efficient buyer review but also gives sellers the chance to pre-screen for gaps or red flags. It reduces surprises and potential delays during negotiations.

Additionally, multiple stakeholders can access the data simultaneously, keeping everyone aligned and accelerating the review process.

2. Improving buyer experience and professionalism

A well-structured deal room signals to buyers that your sale process is professionally managed. Specifically, clear document organization, intuitive navigation, and complete materials demonstrate that you are prepared and thorough. This builds buyer confidence, enhances credibility, and positions your property as a serious investment.

This way, you attract qualified buyers and secure stronger offers, even when selling real estate without a realtor.

3. Tracking buyer engagement and managing multiple offers

Deal rooms provide visibility into how buyers interact with your documents, including which files they view and how frequently. This insight allows you to prioritize serious prospects, anticipate questions, and respond proactively, reducing delays and avoiding lost opportunities.

When managing multiple offers, engagement tracking helps you identify the most committed buyers and act strategically, keeping negotiations efficient and moving faster.

Use case: How data rooms helped a seller pick the right buyer faster

A seller listing an industrial building used a data room to manage multiple interested buyers. Within days, the activity dashboard showed the following pattern:

🔘Two buyers repeatedly reviewed key documents, including the T-12, environmental report, and inspections.

🔘Several others only opened the offering memorandum once.

🔘One buyer submitted targeted questions through the Q&A, demonstrating they were already in active underwriting.

Using this insight, the seller focused communication and tours on the high-engagement buyers. When both serious buyers submitted strong offers, the seller already knew which one was most prepared, well-informed, and likely to close.

The deal closed weeks faster because the team concentrated on the right buyers, thanks to the engagement insights their data room provided.

With the right deal room, you can build the foundation for a more organized sale. However, the technology alone isn’t what drives stronger offers. How you present the property, communicate with buyers, and manage the process matters just as much.

The next section covers practical tips that can help you secure better offers and manage deals more effectively.

Practical real estate sales tips to attract better offers

Use the following recommendations to guide buyers smoothly through the process and improve deal outcomes.

1. Positioning and storytelling for your property

A compelling story highlights the property value, helping buyers see its potential and differentiating it from similar commercial real estate assets.

| Dos | Don’ts |

|---|---|

| Emphasize unique features, location advantages, and tenant stability | Overstate potential or make unsupported claims |

| Use visuals, charts, and verified data from the deal room to support your narrative | Ignore the buyer’s perspective or investment priorities |

| Keep messaging consistent across all materials to provide buyers with the same story and data in every document | Scatter key information across multiple sources |

2. Sales techniques in real estate for negotiating with buyers

Structured negotiations build trust, reduce delays, and encourage serious offers.

| Dos | Don’ts |

|---|---|

| Set clear timelines and data room deadlines Define when each set of documents will be available, when buyers should submit questions, and a firm date for offers to keep the process on schedule. | Leave buyers guessing about timelines or document availability |

| Provide controlled transparency Grant access to sensitive documents only after buyers demonstrate qualification, so information is shared securely and strategically. | Overload buyers with unnecessary data |

| Respond promptly to buyer questions and clarify expectations | Ignore engagement signals |

3. How to increase commercial real estate sales across a portfolio

Managing a portfolio of commercial properties efficiently depends on standardizing your approach. Consistent data organization, document presentation, and buyer tracking reduce errors, accelerate transactions, and create a repeatable process for multiple assets.

| Dos | Don’ts |

|---|---|

| Use consistent folder structures and naming conventions in all data rooms | Treat each property’s data room as a one-off setup |

| Apply checklists for each property to ensure completeness CRE data rooms include built-in checklists that allow sellers to track which documents have been uploaded, reviewed, or are still pending. | Scatter or mislabel documents |

| Leverage activity reports for process improvements Use the VDR’s advanced analytics to see which documents or sections buyers view most, track time spent on each file, and identify areas that may need clarification. | Delay updates |

Strong property presentation, effective buyer management, and consistent processes set the stage for a more efficient transaction process and a profitable sale.

Setting up a dedicated data room for your CRE sale

Take the following steps to structure your CRE data room effectively.

1. Organize essential documents for buyer review

Include all documents buyers need to evaluate the property thoroughly:

- Financial statements, rent rolls, and T-12 reports

- Leases and amendments

- Property surveys, environmental reports, and operational documents

- Photos, floor plans, and other visuals

- Legal documents and supporting contracts

Having these materials organized upfront supports real estate due diligence and reduces delays caused by incomplete or scattered information.

2. Manage access and protect sensitive information

Control access carefully to protect sensitive information while facilitating efficient buyer review:

- Assign access levels based on buyer qualifications

- Require NDAs for confidential materials

- Use staged disclosure, releasing sensitive documents progressively

For sellers evaluating VDR costs: Check data room pricing to compare plans that fit the scale of your CRE sale.

3. Turn your data room into a deal-making tool

Leverage VDR online platforms beyond simple document storage:

- Send messages and updates within data rooms

- Track document status and buyer activity to prioritize follow-ups

- Keep all stakeholders aligned, supporting faster decision-making

By setting up a data room with a clear structure, controlled access, and buyer-ready information, you create an environment where decisions happen faster, and momentum stays on your side.

Conclusion

The success of selling commercial real estate depends on strong pricing, thorough preparation, and effective marketing. A well-organized data room strengthens these essentials by reducing delays, improving buyer access to information, and supporting smoother negotiations.

Whether you’re working with commercial real estate agents or selling on your own, a dedicated data room helps you present your property professionally and keep the transaction moving.